Indian routes stand-out performers of Cathay lacklustre January figures

Contributors are not employed, compensated or governed by TD, opinions and statements are from the contributor directly

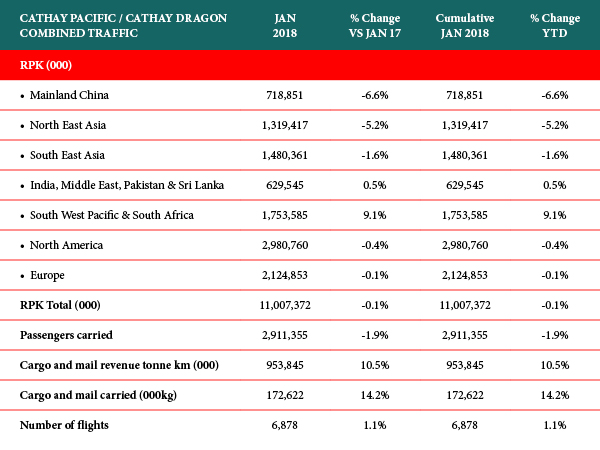

Cathay Pacific Group have released the combined Cathay Pacific and Cathay Dragon traffic figures for January 2018. The numbers show a decrease in number of passengers carried but this is buoyed by an increase in cargo and mail.

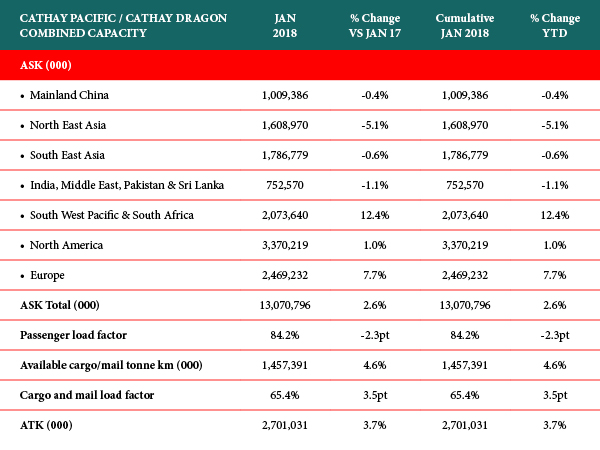

In total, the group carried 2,911,355 passengers last month – a decrease of 1.9 percent compared to January 2017. The passenger load factor dropped 2.3 percentage points to 84.2 percent, while capacity, measured in available seat kilometres (ASKs), saw an increase of 2.6 percent.

The two airlines carried 172,622 tonnes of cargo and mail last month, an increase of 14.2 percent compared to the same month last year. The cargo and mail load factor rose by 3.5 percentage points to 65.4 percent. Capacity, measured in available cargo/mail tonne kilometres, was up by 4.6 percent while cargo and mail revenue tonne kilometres (RTKs) increased by 10.5 percent.

However, I am sure, with the Cathay Pacific Group commitment to expanding their reach into China, continued demand for online derived shipments and the growing need for a superior quality of service, the airline — firmly ensconced as one of the world’s top carriers, is well placed to push on with strength over the coming months. With the upward curve of Indian tourism to countries such as Israel, Thailand and Australia, and beyond, also being a strong factor.

As Cathay Pacific’ director of commercial and cargo Ronald Lam (main picture) said, “Overall performance in January was distorted because of Chinese New Year starting later this year when compared to 2017. Demand for premium class travel continued to be robust during the month, while student return traffic on long-haul routes, especially those to the United Kingdom and Southwest Pacific, was strong early in the month. Indian routes were our star performers, with passenger volumes rising higher than capacity increases.”

“Meanwhile, our cargo business got off to a solid start in 2018. As expected, airfreight volumes subsided a little after the year-end peak, but overall, markets remained relatively buoyant in January. The pre-Chinese New Year rush out of Hong Kong and mainland China was a little softer than anticipated, but this enabled the carriage of more trans-shipment across our network. The inbound load factor improved across all route groups, with overall tonnage growing ahead of capacity. In terms of products, the flow of perishables into Asia and e-commerce movements from the region continued to be healthy in the lead up to the Chinese New Year holiday period.”

Click here for the full January figures.

Comments are closed.