Developing Markets' Online Travel Penetration Set to Soar

Contributors are not employed, compensated or governed by TD, opinions and statements are from the contributor directly

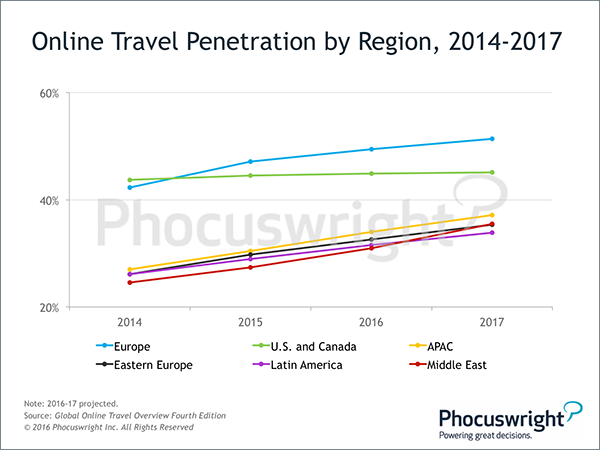

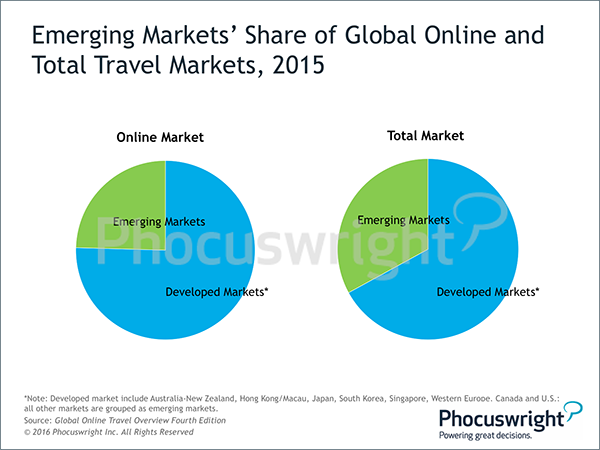

With over 60% of all travel bookings made offline globally, there is still plenty of room for online growth – especially in developing nations. Mature travel markets such as the U.S. and Western Europe may represent 75% of the online travel industry, but growth has slowed as online penetration surpasses 40%. Instead, online sales will expand 61% from 2014-2017 for emerging markets such as China, India and the UAE – a rate four times faster than that of developed nations. Phocuswright’s Global Online Travel Overview Fourth Edition updates online and total travel market sizing and projections for six major regions: the U.S., Europe, Eastern Europe, Asia Pacific, the Middle East and Latin America.

Europe is the most advanced online travel region, with penetration surpassing 47% in 2015. The region will meet a significant milestone in 2017, when more than half (51%) of all gross bookings will be transacted online.

(Click image to view a larger version.)

By 2017, a number of additional travel markets, including Malaysia, U.A.E, India, Brazil and China will cross the 35% mark in online travel penetration. Historically, online travel growth has tended to slow after achieving this landmark of online maturity.

(Click image to view a larger version.)

“As emerging online markets like China and India cross the 35% mark and begin to see growth slow, the most rapid online gains will be in smaller and more nascent markets in APAC, as well as Latin America, Eastern Europe and the Middle East,” said Phocuswright’s senior research analyst, Cathy Schetzina Walsh. “But even among this new generation of ‘mature’ online markets, enormous growth potential remains, particularly as the rise of mobile booking helps to accelerate online growth.”

Cathy Walsh – Senior Research Analyst

Purchase Phocuswright’s Global Online Travel Overview Fourth Edition for the most up-to-date, top-level analysis of the global online travel landscape essential to any company with a focus on travel.